There are only 2.8 months of housing inventory reported in the Austin Multiple Listing System by the Austin Board of Realtors a week ago. There are stories of stampeding buyers trampling agents at open houses. Are buyers in danger of overpaying for homes in an Austin Housing Bubble?

OK, so I made up the bit about stampeding buyers, but at one of Sherlock Homes Austin’s recent listings, we saw over 25 showings in the first two days on market, and 8 showings the day after the home was under contract after we had selected from the multiple offers we received. This story isn’t uncommon – here are other stories of what sound like buyer flashmobs at home listings.

Stepping aside from the hyperbole and the stories, are there statistics that show that the typical home in Austin is being overpaid for? In this post I only use statistics for homes in the City of Austin.

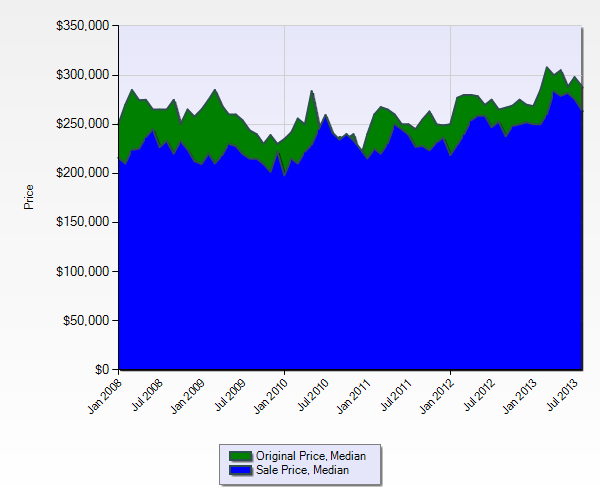

First, lets look to see if all of these multiple offer situations are leading people to pay so much more than the listing price for a home.

While median listing prices are rising, half or more of buyers are actually paying less than asking price. The ratio of sales price to list price is certainly increasing, but we’re not seeing the unsustainable combination of people paying more than is being asked and increasing list prices. Sure, the stuff that makes the headlines is the homes that sell for ten percent more than asking price, but this simply isn’t happening for more than half of the sales.

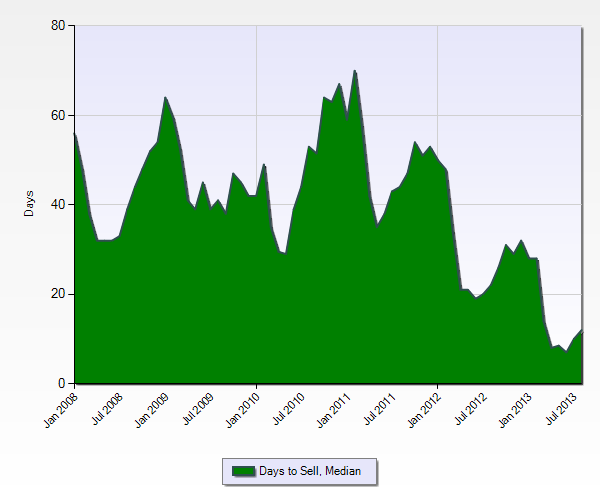

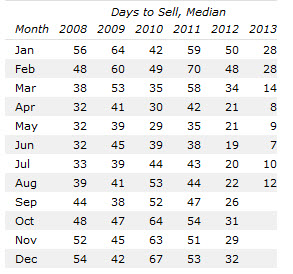

While the Austin area home sale statistics cite 43 days as the average time on market, the chart above shows that half the homes in Austin itself are selling in less than 12 days. The charting software doesn’t really do justice to the numbers, so I’ll include this little data chart. I realize I’m talking medians in Austin, not average in the Austin area – I find it more meaningful.

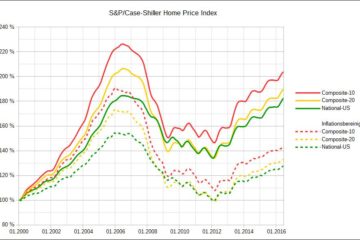

So are we in a bubble at all?

According to industry veterans, not necessarily. Here’s what Texas A&M Real Estate Center Economist Mark Dotzour has to say:

To qualify to be a bubble, there must be a capacity to “burst.” … To get a bubble to burst, you must have a massive imbalance between supply and demand. Either the supply increases too much, buyer demand drops off precipitously, or both happen simultaneously.

It might be that prices are rising steadily, and we’re not anticipating a huge drop in buyer demand. A climb in mortgage interest rates will certainly put the brakes on things, but people are still moving to Austin, and new construction can only ramp up at a certain speed.

So, if we’re not in a bubble, the question becomes simply, how do we become better buyers and sellers in a very low inventory market?

For sellers, price ahead of the market and be prepared to negotiate hard. Choose the very best agent you can to help you get the most from your sale, and don’t be pressured into selling right now, just because there’s no inventory. If home prices continue to rise, take into account the price change in anything that you’re buying, and figure that into your plans.

For buyers, be ready, be willing and be realistic. Choose an agent who is going to be quick to move, and can help position you best in a multiple offer situation. Make sure you can offer something to the inundated seller that no-one else can – don’t just submit a standard contract and hope to get yours in first. It’s not just about price, make sure your agent goes the extra mile to understand what terms are important to the seller and factor those in too.

The best thing I can say right now is to work with an agent you like and trust, and who has been doing this a while. The apparent gold rush brings new agents and part timers flooding back to real estate brokerage, and in this market, the skill of your agent is going to make a big difference to the returns you get as a seller or whether your offer as a buyer even makes it into the top three for the seller to choose from.

Sherlock Homes Austin is a team of full time experienced agents who can help you skillfully navigate the market. Get in touch with us to help you with your next move – 512 215 4785

0 Comments