Most of us understand by now how mortgage rates are influenced by the Federal Reserve’s Discount Rate. The Discount Rate being at 0.00% for most of our economic recovery has been responsible for the record low interest rates we’ve been experiencing – and enjoying – for years.

However, we should be careful not to let ourselves be lulled into thinking this is the new norm. It is not. Sooner or later, the prime rate will go up – and mortgage rates with it (as we’ve been saying for years). The Fed has been waiting for our economy to get stronger – and we are now experiencing a strong and strengthening economy.

We don’t know exactly when interest rates will rise, but we know that they’ll have an impact on what we do every day. The Fed will raise rates. The only question is when.

Are you gambling on the Fed? photo credit: Jeremy Brooks / flickr

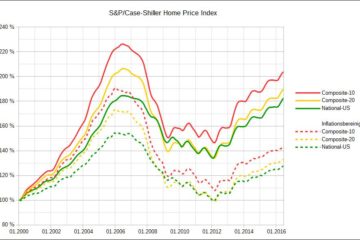

When that happens we can almost certainly count on the housing market in Austin hitting a wall. This is not difficult to understand. People’s buying power has been enhanced by the lower interest rates and this has very much contributed to our strong real estate market. It has excited and motivated would-be buyers and sellers for years.

The good news is, as we have seen in the past, home values in Central Austin shouldn’t be hurt, but the rate of appreciation may slow down or even stall for a time. This is not as true of the suburbs. We have no way of knowing if this will affect us for weeks, months, or years, but preparing for this eventuality is important. We need to take it seriously.

One thing we know for sure, there will be many, many disappointed people who were going to sell their homes and cash in the rise in values ‘next year’, or buy a house ‘next year’. Don’t let this be you! Whether you’re getting ‘greedy’ about your home’s increasing value, or waiting a little longer to buy or trade up – gambling on the Fed could cost you dearly!

Give us a call on 512 215 4785 if you’d like to talk through your home buying and selling options.

0 Comments