It might not be Fall time for Austin in 2015 – photo: flickr/treasuresthouhast

If you’re thinking of buying or selling an Austin home in 2015 you’re probably asking what the market will do this year. After last year’s shock headlines that Austin was 19% overvalued (good link bait Zillow!) there was a second report released in December that claimed Austin was 20% overvalued – this time from Fitch Ratings. Scary stuff if you’re trying to buy a house. But this view isn’t held by local economist Angelos Angelou.

In January Angelou said in his annual address that prices have gone up quickly but the underlying value is there:

“We’re not overpriced. We have a high price,” Angelou said. “Our home prices have gone up way too fast too quickly. We need (more) supply to take care of that.”

He also noted that Austin has the most expensive housing in Texas, and that more than 40% of Austinites pay more than 35% of their income for housing. The City of Austin states that spending a maximum of 30% of income on housing is affordable, which implies Austin is becoming unaffordable for many. The high prices trickle down to renters too with a predicted rise of 4.5% in rent in 2015 (source – Berkadia Commercial Mortgage). This compares to the Austin Board of Realtors data of a 2014 increase in rental rates of 2%.

If working class people are pushed to the suburbs for more affordable housing, this puts pressure on the transport system – this is why Angelou is advocating a subway.

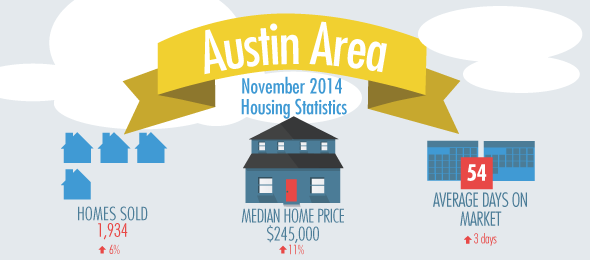

The latest ABoR report is more of the same – median home prices up 11% in 2014, sales volume 6% higher and only a slight increase in available inventory – while this increased a small amount from 2.3 months of inventory in November 2013 to 2.4 months of inventory in November 2014, this is still far away from a balanced market.

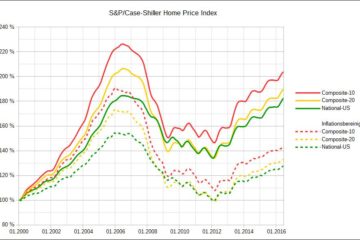

While it’s hard to predict when Austin’s housing market will become more balanced, we can look at the key drivers of the market. If the local economic drivers are population growth, enterprise and technology, education, health and the festival industry, hopefully Austin might be shielded from the predicted cutbacks in the energy sector with the price of oil plummeting. But it can’t be shielded from macroeconomics.

The big issue this year might be interest rates. If you look at any list of top 4 or top 5 real estate predictions for 2015, rising interest rates will be one of them. This coupled with the recent rises in house prices will be a double whammy for affordability. Check out this article to see if waiting or acting might best serve you: If interest rates are going to rise, what does this mean for buyers and sellers?

Sherlock Homes Austin can help you make sense of the Austin real estate market – give us a call on 512 215 4785 and we can consult on your upcoming decisions.

0 Comments